Secondaries are not the sideshow

IN Partnership with

Secondaries are emerging as the stabilizing centre of long-term portfolios, offering cash flow, shorter duration, and insulation from timing risk

More

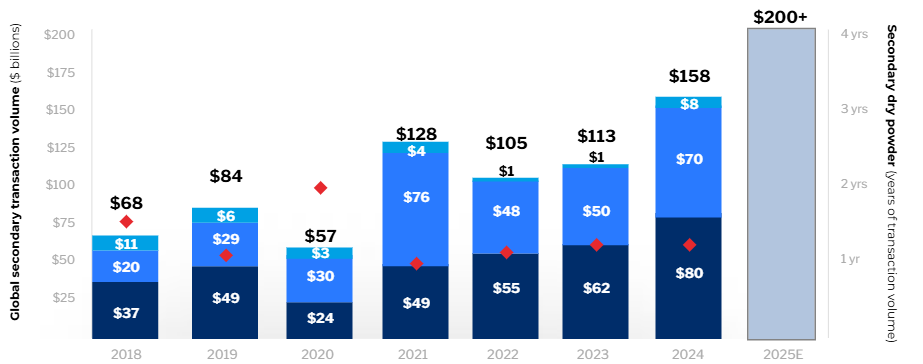

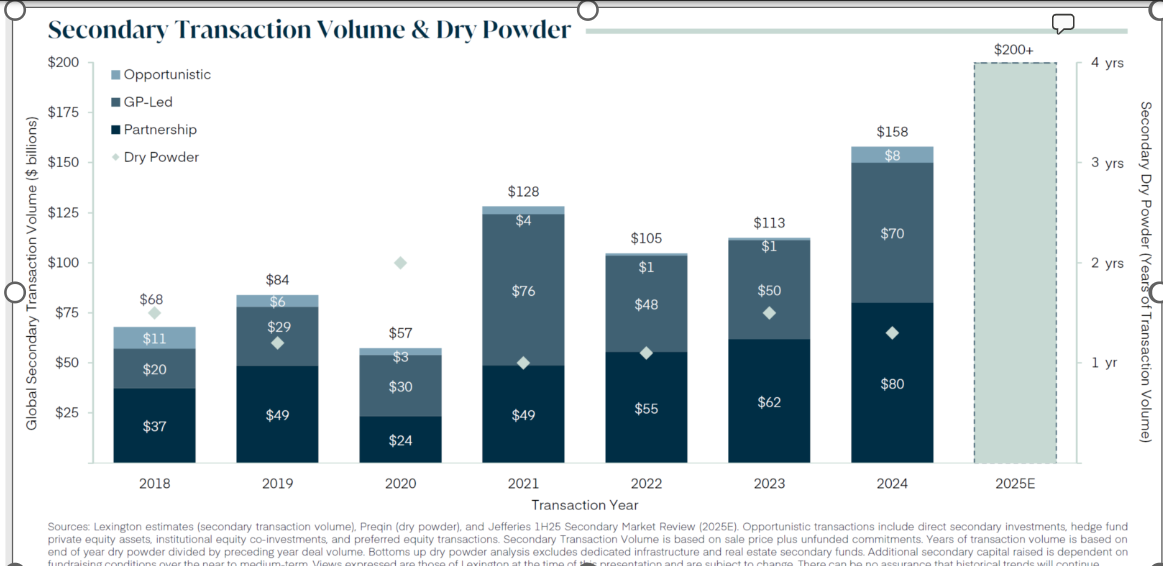

IN 2008, the global secondary private equity market transacted just US$9 billion in volume. In 2024, that number reached US$158 billion. This year, it may exceed US$200 billion, based on first-half reports.

Firms like Lexington Partners (“Lexington”), one of the largest and longest-tenured players in the space, reviewed over US$300 billion in potential deals last year. That number isn’t an indication of what could be done; it’s a reflection of what sellers, both institutional limited partners (“LPs”) and general partners (“GPs”), were actively seeking to transact.

“We saw about twice as much volume as what actually traded,” says Taylor Robinson, a New York-based partner at Lexington. “The imbalance tells you everything. There’s more supply than capital. The market is still structurally undercapitalized.”

Robinson has spent nearly two decades in secondaries, leading investments and syndication efforts and increasingly working on capital formation. What he sees today is not just a market that’s scaled but one that’s changing shape. Behind the headline growth lies a backlog of aging assets, delayed exits, and fund structures no longer aligned with asset duration. Although the market has grown to accommodate GP-led deals and continuation vehicles, the broader challenge − the one with the most volume − remains largely unaddressed.

Franklin Templeton Investments Corp. is a global investment management organization with subsidiaries operating as Franklin Templeton and serving clients in over 150 countries. In Canada, the company’s subsidiary is Franklin Templeton Investments Corp., which operates as Franklin Templeton Canada. Franklin Templeton’s mission is to help clients achieve better outcomes through investment management expertise, wealth management, and technology solutions. Through its specialist investment managers, the company offers specialization on a global scale, bringing extensive capabilities in fixed income, equity, alternatives, and multi-asset solutions. With approximately 1,300 investment professionals and offices in major financial markets around the world, the California-based company has over 75 years of investment experience and more than US$1.5 trillion (over CAN$2.1 trillion) in assets under management as of March 31, 2025.

Find out more

“For a long time, fund restructurings were viewed as one-off fixes. But structurally, this is where the volume is heading. If secondary investors are going to meet it, we need to evolve how we allocate and engage”

Taylor Robinson, Lexington Partners

Most of the market’s focus to date has been on providing liquidity for LPs and high-performing assets. That includes institutions selling fund stakes and sponsors carving out select companies into continuation vehicles. Those deals will continue to be a key component − if not the main focus − of the secondary market. But beyond those deals lies a more complex inventory: large, aging pools of assets stuck inside legacy private equity funds.

“These are portfolios that haven’t seen a path to liquidity,” Robinson says. “And many are substantial, both in dollar terms and in the number of companies involved.”

These portfolios − often containing dozens of companies across several vintages − typically sit in funds approaching or past their term limits. The challenge is structural. Restructuring such portfolios requires capital, expertise, alignment with GPs, and the ability to underwrite at scale. It also demands a change in mindset.

“For a long time, fund restructurings were viewed as one-off fixes,” he says. “But structurally, we believe this is where the volume is heading. If secondary investors are going to meet it, we need to evolve how we allocate and engage.”

Restructuring those funds − once considered edge cases − is increasingly being viewed as a necessary evolution. But unlocking such opportunities will require a larger capital base and more flexible approaches than the market has relied on to date.

Properly pricing and executing secondary deals, especially complex ones, demands deep familiarity with managers, detailed knowledge of assets, and the ability to underwrite thousands of positions with precision. That kind of scale and institutional memory is difficult to replicate.

“Lexington has reviewed a very large number of deals and invested with numerous sponsors over the years. We know these GPs. We’ve watched the underlying portfolio companies develop,” Robinson says. It’s not just a spreadsheet exercise. It’s also, importantly, pattern recognition developed over many years.”

One reason the secondary market is attracting fresh attention is a shift in investor perception. Where secondaries were once viewed as opportunistic, they’re now seen as structural and commonplace. For institutions facing capital constraints or delayed distributions, secondaries offer a release valve. For clients entering private markets for the first time, they offer an attractive, diversified starting point.

Negotiated purchase discounts, while often cited, are not necessarily a buyer’s top priority or a reliable signal of value. In a market where NAVs are marked quarterly and trades are priced off valuations from months earlier, secondary buyers must forecast not just current worth but forward performance. A deep discount can evaporate if portfolio marks are about to fall.

“We’re not just looking to buy what’s cheap,” Robinson explains. “We’re looking to purchase what we believe will return capital in line with our goals and expectations. That’s a very different proposition.”

The deeper argument for investment in secondaries lies in their role within portfolio construction. For seasoned LPs, they can smooth pacing, provide early cash flows, and add ballast to direct exposure. For newer allocators, they can serve as an efficient entry point with reduced blind pool risk and shorter duration.

“We’re seeing investors come full circle,” Robinson says. “Some started with secondaries, went direct, and now are coming back. Not because secondaries have changed, but because secondaries can form a vital portion of their portfolio.”

That shift in perception has prompted Lexington Partners and Franklin Templeton to launch the Franklin Lexington PE Secondaries Fund, an access vehicle designed specifically to broaden exposure to the strategy to professional or other sophisticated investors via wealth and intermediary channels.

“We’ve spent decades building institutional capabilities in secondaries,” Robinson says. “Now we’re seeking to apply that to a broader base of investors who want diversified access, shorter duration by acquiring established underlying funds, and attractive risk-adjusted return potential in private markets.”

As the secondary market expands, strategies are beginning to diverge. Some managers focus on concentrated GP-led deals, others on diversified LP interests. Some rely heavily on utilizing leverage to enhance returns. For financial professionals evaluating opportunities, this diversity means diligence is no longer optional.

“Secondary funds used to look pretty similar,” Robinson says. “That’s no longer true. The outcomes will diverge, and advisors will need to ask better questions about the details of a GP’s investment strategy and how past results have been achieved.”

He encourages financial professionals to evaluate how a manager balances discounts versus capital appreciation in the underwriting process, whether and how it uses leverage, and how stable the investment team has been over time.

“Secondary funds used to look pretty similar. That’s no longer true. The outcomes will diverge, and advisors will need to ask better questions about the details of a GP’s investment strategy and past results”

“It’s about understanding how portfolios are being constructed, how historical results have been achieved, and whether the process can be repeated in different market conditions,” he explains, adamant that, despite record-setting volumes and growing institutional acceptance, the secondary market is still in its early stages.

“If you’d asked me five years ago what inning we were in, I might have said the seventh. Now I think we’re back at the second. There is just so much that has to happen.”

For institutional investors, that means the window for early positioning is still open. Future growth will likely come from deeper market engagement, more capital, more innovative and structural solutions, and more professionals treating secondaries not as a niche play but as essential infrastructure.

And perhaps what’s drawing that shift is not the promise of headline-grabbing returns but something more predictable and sustainable.

“What secondaries can provide is sort of a ballast to a portfolio,” he adds. “They can be the central part of a private equity program around which you can start to make more alpha-generating commitments.”

For institutional investors and plan sponsors building multi-asset portfolios, the implication is clear. Secondaries have evolved beyond their traditional role as a liquidity solution or tactical allocation. They are increasingly being viewed as a strategic component within portfolios, offering potential for diversified exposure to private markets with characteristics that may include more stable cash flows and reduced volatility.

“It’s a very exciting time to be a liquidity provider,” Robinson says. “And as a firm, we feel very lucky to have been doing this for a long time.”

Share

Unlocking what hasn’t moved

Secondaries as infrastructure, not opportunity

Published September 8, 2025

Share

About

Directories

Resources

Investments

Pensions

benefits

News

RSS

Sitemap

Privacy

Contact us

About us

External contributors

Authors

Terms & Conditions

Terms of Use

Subscribe

People

Companies

Copyright © 1996-2025 KM Business Information Canada Ltd.

About

Directories

Resources

Investments

Pensions

Benefits

News

RSS

Sitemap

Privacy

Contact us

About us

External contributors

Authors

Terms & Conditions

Terms of Use

Subscribe

People

Companies

Copyright © 1996-2025 KM Business Information Canada Ltd.

About

Directories

Resources

Investments

Pensions

Benefits

News

RSS

Sitemap

Privacy

Contact us

About us

External contributors

Authors

Terms & Conditions

Terms of Use

Subscribe

People

Companies

Copyright © 1996-2025 KM Business Information Canada Ltd.

Dispersion, discipline, and due diligence

Taylor Robinson, Lexington Partners

$68

Secondary transaction volume & dry powder

2018

2019

2020

2021

2022

2023

2024

2025E

$37

$20

$11

$49

$29

$6

$84

$200

$175

$150

$125

$100

$75

$50

$25

Partnership

GP-led

Opportunistic

Dry powder

4 yrs

3 yrs

2 yrs

1 yr

Secondary dry powder (years of transaction volume)

$24

$30

$3

$57

$49

$76

$4

$128

$55

$48

$1

$105

$62

$50

$1

$113

$80

$70

$8

$158

$200+

Global secondary transaction volume ($ billion)

Sources: Lexington estimates (secondary transaction volume), Preqin (dry powder), and Jeffries 1H25 Secondary Market Review (2025E). Opportunistic transactions include direct secondary investments, hedge fund private equity assets, institutional equity co-investments, and preferred equity transactions. Secondary transaction volume is based on sale price plus unfunded commitments. Years of transaction volume is based on end-of-year dry powder divided by preceding-year deal volume. Bottoms-up dry powder analysis excludes dedicated infrastructure and real estate secondary funds. Additional secondary capital raised is dependent on fundraising conditions over the near to medium-term. Views expressed are those of Lexington at the time of this presentation and are subject to change. There can be no assurance that historical trends will continue.

Disclaimer��This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell, or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager, and the comments, opinions, and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region, or market.

Franklin Lexington PE Secondaries Fund is sold pursuant to the Offering Memorandum exemptions to qualified Canadian investors. Each investor must therefore qualify for an Offering Memorandum exemption in their jurisdiction of residence. Generally, this requires that an investor qualify as an “accredited investor” (as defined in securities legislation) and purchase the Fund as principal.

This document does not constitute an offering of any security, product, service, or fund, including interests in Frankling Lexington PE Secondaries Fund (the “Fund”), which can only be made to qualified investors through, and in accordance with, the terms of the Fund’s subscription agreement and confidential private offering memorandum (collectively, the “Offering Documents”), and the constitutional documents of the Fund. The information in this document is for informational purposes only and is not intended to provide legal, accounting, tax, investment, or financial advice and should not be relied on in that regard. It is qualified in its entirety by the Offering Documents of the Fund and no offering of interests in the Fund may be made by any literature, advertising, or document in whatever form other than the Fund’s Offering Documents, which supersede and may qualify, and differ from, the information and opinions contained herein.

The Offering Documents of the Fund contain important information regarding the Fund’s and the Initial Underlying Fund’s (as hereinafter defined) investment objective, strategies, restrictions, risks, fees, redemption limitations, liquidity, certain material conflicts of interest, and other matters of interest. There are no assurances that the stated investment objective of the Fund or the Initial Underlying Fund will be met. Units of the Fund are only sold to purchasers that qualify as “accredited investors” in reliance on prospectus exemptions in each of the provinces and territories of Canada. As the Fund is a prospectus exempt fund, it is not subject to the same regulatory requirements as publicly offered investment funds offered by way of prospectus.

The Fund is a Canadian access fund established as a trust under the laws of the Province of Ontario that will invest substantially all of its investable assets in shares of Franklin Lexington PE Secondaries Fund (the “Initial Underlying Fund”), a sub-fund of Franklin Lexington Private Markets Fund SICAV SA. The Initial Underlying Fund is part of an umbrella investment program referred to as FLEX. The investment objective of FLEX is to seek long-term capital appreciation, and FLEX seeks to achieve this investment objective by investing in a portfolio of private equity and other private assets.

All investments are subject to certain risks. The risks associated with private equity and other private asset investments involve a high degree of risk, may be considered speculative, and are suitable only for accredited investors who can afford to risk the loss of all or substantially all of such investment. Less information may be available with respect to private investments and such investments offer limited liquidity. Complete information relating to the Fund, including risk factors, is contained in the Offering Documents. The information in this document is subject to change without notice; as such, only the most recent Offering Documents should be relied upon for information on the Fund.

The returns of the Fund are not guaranteed, the value of units of the Fund may change frequently, and past performance may not be repeated and is not indicative of future results.

Franklin Templeton Canada is a business name used by Franklin Templeton Investments Corp.